Federal stimulus programs offer relief for CNY businesses

Stimulus programs offer relief for CNY businesses

An unprecedented level of federal stimulus will be distributed with $377 billion in loans and grants meant to assist small businesses facing ongoing hardship during the crisis. Central New York businesses, some already operating on thin margins, urgently need this support to maintain payroll and make ends meet.

The most significant part of the federal stimulus for the region is $350 billion in Paycheck Protection Program (PPP) loans.

These loans can be used to cover payroll costs including salaries, commissions, insurance premiums, and payment during periods of sick, medical or family leave. Other expenses such as rent, mortgage obligations, utilities, and interest on debt, are also covered. Medium-to-small sized businesses can apply for the zero-fee loans through the Small Businesses Administration (SBA) 7(a) program, an existing framework for receiving long-term working capital.

The law mandates that businesses eligible for PPP must have less than 500 employees. Sole proprietorships, independent contractors, self-employed individuals and certain non-profit organizations are also eligible. Businesses do not have to prove revenue loss during the application process for the program. Owners must show that proceeds were used for in order for the loan to be fully or partially forgiven.

According to Rob Simpson, CenterState CEO and president, this is an efficient way of getting stimulus to where it’s needed most.

“We want to try and get money to as many companies in Central New York as quickly as possible,” Simpson said on a webinar his organization held for companies and stakeholders. “This is one of the more innovative public policy options that we’ve seen come out Washington in a while.”

While the money comes from the top-down as fully guaranteed SBA lending programs, the banks end up administering it . “There will be very little in terms of closing costs and no co-signing either,” said U.S. Rep. John Katko, who also appeared on the webinar. “Not all the typical paperwork you have to go through. People should talk with their accounts, traditional banks, or lending partners, and do it quickly. This portion of the stimulus will probably help Central New York more than any other part.”

An alternative option for local businesses in distress is the Economic Injury Disaster Loan (EIDL) Program.

These particular loans dole out up to $2 million to help overcome temporary loss of revenue, fixed debts, increased production costs due to supply chain disruptions, pay roll, or other bills that can’t be paid because of COVID-19. With EIDL, small business owners also have the opportunity for an immediate advance of $10,000 within three days of the request.

Katko, who represents Onondaga, Cayuga, Wayne and part of Oswego County, supported passage of the stimulus to reduce the financial burden crippling the district. “The idea is to get hands in the money of small businesses immediately, and to the employees, to try and stem the bleeding as best we can for now,” he said. “More [relief] is going to be coming most likely that when this is over, these businesses won’t be so wounded that they won’t be able to get back up and running again.”

The next most important portion of the stimulus that directly impacts the region is $100 billion in emergency funding for health care centers. Hospitals are struggling to make up for lost revenue as they cut back elective surgeries and other procedures in order to treat patients for the virus. This loss combined with increasingly high demands for staff, services and supplies leaves them with even less. For an area concentrated with high-quality health care institutions, the system is being stressed and taxed in ways like never before.

The emergency funding is a sizeable down payment for what is needed to keep local hospitals functional during a crisis including more protective gear, testing supplies, ventilators and telehealth technologies. Hospitals treating Medicare patients for COVID-19 will additionally get a 20 percent payment increase.

According to Katko, this shows how healthcare industry recommendations and public support were able to influence a lifeline in returns.

“Some of the hospitals, especially regional hospitals are in very precarious financial situations,” he said. “We were in this state before virus happened. Some of them had less than ten days cash on hand, and now they’re told to stop their elective surgeries, which is the lifeblood of their funding mechanism…Last thing we need is local hospitals to go under, I think this bill is really going to prevent them from doing that.”

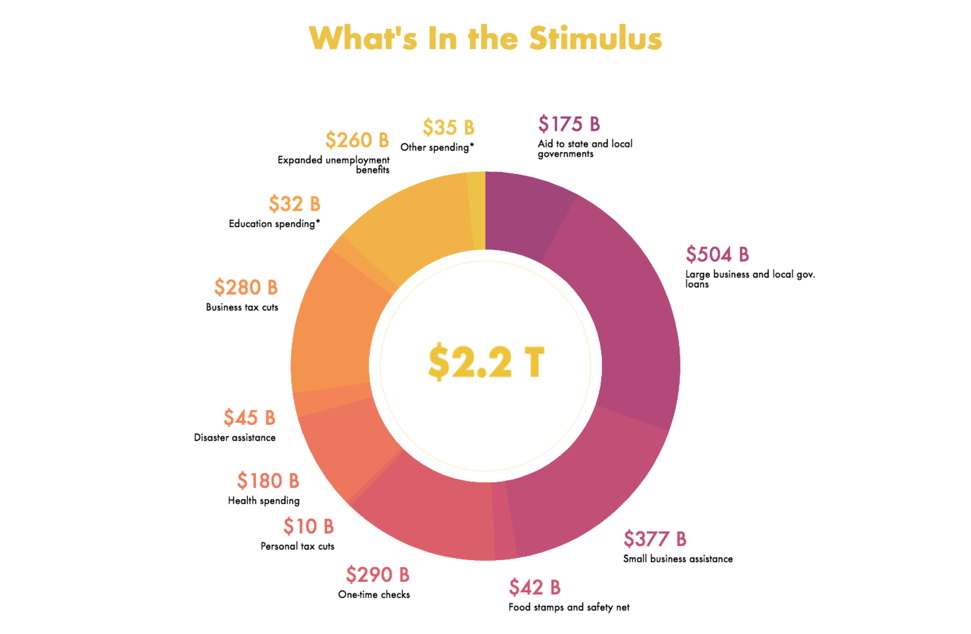

The rest of the stimulus includes $504 billion in large business and local government loans, $290 billion in direct support for individuals, $280 billion in business tax cuts, $260 billion in expanded unemployment benefits, $174 billion in aid to state and local government, $45 billion in disaster assistance, $42 billion for food steps and the safety net, $32 billion in education spending, $10 billion in personal tax cuts and $35 billion in other spending. When implemented, these resources will be made accessible for community members to handle their concerns as taxpayers, consumers, and part of the employment base.

There are, however, further developments to monitor before things are back to business as usual.

“This is a different animal that we’ve never seen before, I think we need to think differently than we have in the past,” said Simpson. “We need to look at this with a sober reality. Two weeks from now we will not be back to normal, that’s not reality. We have to take a defensive posture; it’s hard to tell how long it will take to recover.”

The CARES Act is the third phase of an extensive government response. Put together as a common-sense package, its initiatives preserve the payrolls for as long as possible and compensate the workforce for their losses. Katko describes these as crucial first steps to stabilize recovery.

Katko indicated there will be more to come in the next phase, and that a way back is in sight large part due to the support coming in now. “I think that the recovery time is going to be a lot better than a lot of people think,” he said. “Once this crisis is over, we will be able to recover quicker because of some of the things we’re doing.”