Fixed rate

Why luxury student apartments across the country cost about the same

In the past decade, new luxury student apartment buildings near Syracuse University added 3,191 more beds for students to rent. This is just a fraction of the 435,000 beds added across the country in the same time period, according real estate data company Axiometrics. But whether a student lives near Syracuse University or Texas A&M, the one thing that’s the same is the rent.

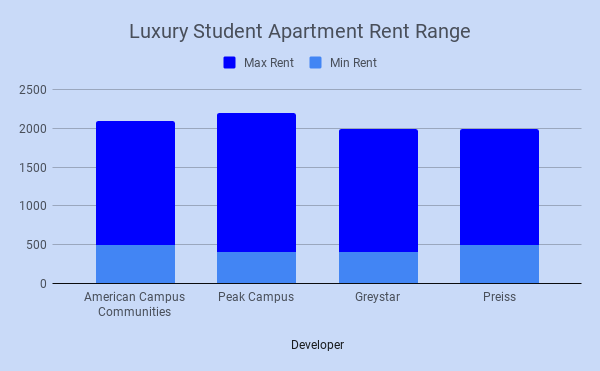

Four large companies – American Campus Communities, Peak Campus, Greystar and the\ Preiss Company – manage student housing nationwide. American Campus is by far the largest, with more than 350 properties in its portfolio. Locally, American Campus owns Park Point and U Point. The other companies are a distant second. Peak Campus (Theory) has 89 properties , Greystar (UV on Colvin) controls 87, and Preiss only 65.

These companies own properties all over the country, near public and private institutions. Tuition ranges widely, as does the median rent in the cities and towns these schools call home. But no matter the tuition or city’s rental market, there was almost no variation in rents at any of these luxury student apartments.

Out-of-state tuition at the University of Michigan is about $52,000. The University of Minnesota costs nearly $20,000 less for out-of-state students. The median rent in Ann Arbor, Michigan, is $1,166. Median rent in Minneapolis is $941 according to the Census Bureau. But luxury student apartment rents are about $1,300 a room.

The same case applies to privately developed on-campus housing. At Syracuse University, University Village on Colvin rents at $1199 and University of Houston Cullen Oaks rents at $1033. Despite University of Houston’s tuition being less than half of Syracuse University’s, the rents do not change.

As the rent at luxury student apartments prove to be similar nationally, it’s questionable whether these fixed rents obey the laws of real estate. Gary Painter of the American Real Estate and Urban Economics Association suggests this phenomenon isn’t unusual at all. Luxury student housing companies are not thinking about pricing looking at a purely local market, he hypothesizes, but on the housing market which includes a paired bundle of tuition and housing.

Companies may be making their prices based on is a combination of what a tuition might be to a comparable school and what housing cost package might be at a comparable school, Painter explains. So parents and students looking for housing at comparable schools, developers can say this is what it would overall cost to live in luxury student housing.

“We may be seeing an equilibration happening comparing the luxury market at a state college in Illinois to a state college in Georgia in which the luxury market compares,” Painter said.

The demand from students and parents to live in nicer, safer housing plays a role in the similar rents, Painter adds. By making a product more attractive, developers can essentially set the highest price possible as long as the demand is there.

“There’s something unique in the experience of this type of housing than the other type of housing,” he said.

“They’re not competing with the local housing market directly, but directly competing against other universities and total cost of tuition versus housing. So, what you end up seeing is kind of a relatively flat price difference, and that’s where you see the competitive force working in this bundle of luxury housing and tuition,” Painter said.

Universities tend to be located in mid-sized cities, where stable construction costs can help keep rents similar, said Titman Sheridan, head of the Real Estate Finance and Investment Center at University of Texas at Austin. But college campuses tend to drive up the cost of land nearby. In South Bend, Indiana, home of of the University of Notre Dame, the city median rent is $646 and the luxury apartment range is $850 to $1,030, In Charlottesville, Virginia, where the University of Virginia is located, the city rent is $1,089 and the luxury rent range there is $789 to $1,405.

“Although South Bend is quite a bit cheaper on average than Charlottesville, the land near campus is likely to be quite expensive in both towns,” Sheridan said.

A company representative from Greystar, Craig Wack, explained in an email that the company determines rates by considering location, cost of building construction or acquisition, unit type, unit size, and comparisons with similar apartments in the area. At Syracuse University, Greystar owns Campus West, where a one-bedroom apartment rents for $1,540 and a four-bedroom for $999 a room. Because Campus West apartments are furnished and the building has amenities like a fitness center and study lounge and utilities and internet costs are included with the rent, Wack says the “effective rents” are about $850 a month. Traditional student apartments may cost less per room, but tenants may have to share a bathroom and pay for utilities on top of their monthly rent.

Room and board costs provide another way to view student apartment data. According to an Urban Institute study, average room and board costs at public and private four-year universities were about $10,000 as of 2014. These costs continue to rise; room and board at Syracuse University, for example, is now more than $15,000. Renting one of these off-campus luxury apartments and eating on the cheap can actually be a cheaper option.

Universities can continue to increase room and board costs even with new competition from new apartment buildings because on-campus residence halls will always have better locations than any off-campus apartments, said Painter, the housing and urban economics expert. There’s also still a demand for the college experience.

“You’re providing an experience – the college experience – that is unique. As long as the universities charge those prices and they’re filling up the dorms, they’re going to continue to do that,” Painter said.

Here in Syracuse, prospective renters seemed undeterred by these high-cost apartments. Representatives from The Marshall, the 505 on Walnut, Park Point and Copper Beech Commons all reported occupancy rates between 90 percent and 100 percent.