What is Bitcoin, and should you invest?

What is Bitcoin, and should you invest?

Cryptocurrency has fascinated Zachary Goldstein since 2017, when he was a junior in high school living in Wayland, Massachusetts. He wrote his college essay on the future of blockchain — the technology behind cryptocurrencies. And landed a spot in the Information Management and Technology school at Syracuse University

Bitcoin (BTC) was at around $7,000 when Goldstein, now a junior studying Information Management & Technology at Syracuse University, first invested. But in April 2021, after a recent surge, BTC was valued at a high of $64,841. That’s more than an 800% increase. Goldstein said he’s also invested in alternative coins like Ethereum, Dogecoin, and Ripple, less popular cryptocurrencies which prices tend to mirror that of BTC.

Cryptocurrency has been on the rise worldwide, and despite its volatile nature — as of June 3, BTC has fallen below 40,000 — is viewed by many as a legitimate commodity. This April, the cryptocurrency market was valued at over $2 trillion, a bigger market cap than Apple. Millennials and college students — like ones at SU — have tended to be more involved with crypto than traditional forms of investing.

Goldstein, the vice president of SU’s new crypto club, represents that trend. His goal with the club is “just to raise awareness and educate more people who want to learn about cryptocurrencies.”

“Because (they’re) going to be here for good,” Goldstein said. “It’s just here to stay.”

What is Bitcoin?

SU associate professor Lee McKnight likes to explain Bitcoin in terms of analogies. Bitcoin is a commodity, not unlike wheat, gold or oil, he said. It’s a digital asset that people can trade anonymously across the globe, that’s value fluctuates based on several factors — like all commodities.

Bitcoin’s also a finite resource, meaning there will never be more than 21 million. It’s a controlled supply.

“So there’s sort of built-in scarcity,” McKnight, who’s taught a blockchain management course at Syracuse since 2017, said. “Because like with wheat, you can always grow more wheat. But Bitcoin, there’s a limit to how many will ever exist.”

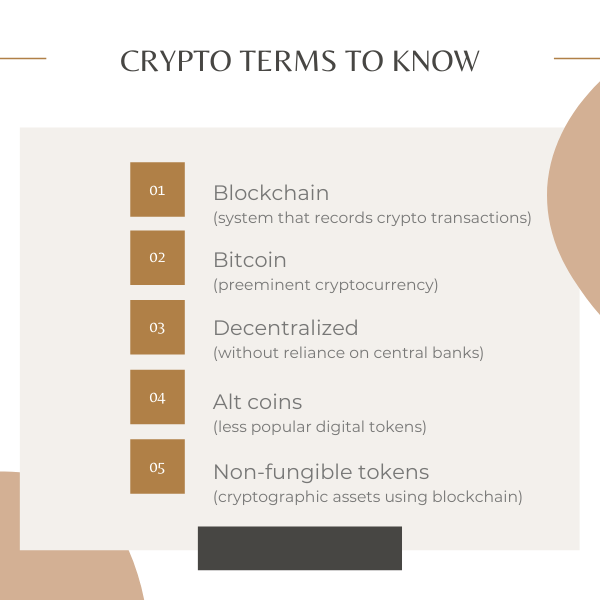

It’s not exactly that simple. What makes Bitcoin Bitcoin, in part, are the aspects of decentralization, blockchain technology and mining. Bitcoin started in 2008, during the 2008 US financial crisis which caused skepticism of mainstream banks. Bitcoin founder Satoshi Nakamoto envisioned a digital peer-to-peer payment system with no third-party financial institution involvement. Users wouldn’t need to trust central banks.

Then, the key to Bitcoin is the technology behind it — the same one McKnight teaches about. Blockchain is the system of information that makes Bitcoin transactions official. Every trade is recorded in the blockchain network to track assets. Goldstein compared it to a commandment tablet — “it’s written in stone and you can’t change it.”

And finally, mining is the process of confirming if a transaction is legitimate. The process is done by extensive computer algorithms, do this with complicated computer processes, and the digital mining can actually be harmful to the environment. The biggest Bitcoin mining farm in North America is located in Massena, New York, just about three hours from SU’s campus.

Crypto mining — as well as regulations — reduces the risk of fraud, money laundering and other criminal activity, McKnight said.

“The reason these trusted digital assets exist and can be used, bought and sold by people anonymously that don’t know each other around the world is that there’s what’s called a consensus mechanism,” McKnight said. “Like a consensus on what’s true, on whether there’s a transaction that’s valid.”

Bitcoin gained popularity in the years after 2008, with an early surge in late 2017 and early 2018. It then declined significantly, resulting in less interest in McKnight’s course. But confidence from financial institutions, as well as Coinbase’s initial public offering, fueled April 2021s summit.

Should you invest?

There are several concerns with Bitcoin and other cryptocurrencies such as alt-coins or the newly popular non-fungible tokens, but both McKnight and Goldstein have faith in the macro.

“I wouldn’t be teaching these classes if I didn’t believe in the long-term merits,” McKnight said. “There is this kind of magic of it, of having decentralized, distributed trusts. So an architecture for a decentralized trust — just think about the last year, when we’re all living in a very decentralized manner. If you have a mechanism for maintaining trust, better security, and architecture for many different types of assets.”

On the other hand, the volatility of Bitcoin can be concerning. There are market-movers like “pump-and-dump scammers,” including Elon Musk, McKnight said. Government regulation has helped Bitcoin thus far, especially in New York, but could potentially hurt it in the future. Goldstein likened his attitude toward investing in crypto to “throwing away your money at a poker table” — because of the possibility of high returns, there’s inherent significant risk as well.

Goldstein, who’s not a professionally trained investor, said he’d put between 1-5% of however he’d usually invest in the stock market and put it toward cryptocurrency’s industry leaders — Bitcoin and Ethereum, for example.

“What I tell my students is don’t put any money into any of this stuff that you’re not going to be able to buy your food for next week or rent for next month,” McKnight said. “But beyond that, over time, there will be more and more uses of blockchain and also of digital assets like cryptocurrencies or NFTs. So in many ways, this is like the very beginning of all that stuff.”

Bitcoin itself also has limitations, McKnight noted. Since it’s the first mainstream cryptocurrency, its technology may be less applicable than that of other or future competitors. McKnight sees BTC more like a “digital gold” asset than a technology widely adopted to make payments.

“I’d be a much wealthier man if I actually had projecting capabilities,” McKnight said. “It could swing down to 20,000 in a few months, it could swing back up to 100,000. The only thing I will predict is continued swings and prices because it’s a commodity.”